Globally, maize production has come under pressure due to increased consumption and poor growing conditions. World maize markets have a direct impact on South Africa’s domestic market, as the import and export parity prices effectively become a broad band within which domestic prices can vary, depending on our own domestic stock levels.

World maize market trends

For a number of years, consumption has exceeded production, decreasing stocks and driving prices to record highs. This has created an incentive for producers to enter the market. Initially, increases in planting were expected this year, and indications were that production would exceed consumption and increase stock levels again. However, poor weather in the US is set to lower yields.

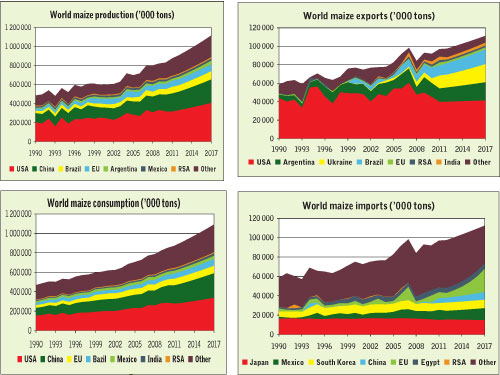

Production: World maize production was estimated to be 950 million tons for the 2012/2013 season, an increase of 9% from 2011/2012. The US is the largest producer, responsible for about 40% of total output. It was initially estimated that this country would produce about 377 million tons of maize in 2012/2013, an increase of 20% from last season’s 313 million tons. However, the weather interfered; a month after predictions of a record harvest, the US experienced its worst drought in 53 years. Predictions are now that there could be a drop of about 20% in its yield.

China, the next largest maize producer, is expected to produce 195 million tons (20,4%), slightly higher than last season’s 192,7 million tons. These two countries are followed by Brazil (67 million tons expected), the EU (65,5 million tons) and Argentina (25 million tons). EU production has been stable for five years, while production in Brazil and Argentina has grown due to increased world demand, lower world stock and higher prices.

Exports: World maize exports are estimated to be 97,4 million tons for 2012/2013 – a slight increase of 475 000t from the previous season – if demand continues as predicted. However, it may slow down somewhat if expected production continues to decrease. World maize exports have increased at an average annual rate of 3% over the past 10 years from

74,5 million tons, due to strong increases in import demand, mainly from China, Mexico and the EU.

The US is the largest exporter of maize, with a predicted figure of 40 million tons for the 2012/13 season, or 41% of total world maize exports. Next comes Argentina at 15,5 million tons (15,9%), the Ukraine at 14 million tons (14,4%), and Brazil at 12,5 million tons (12,8%). Due to increased production and its location, Ukraine has become a major player.

Consumption: Maize consumption has shown constant increases over the past 10 years, as strong economic growth in the developing world, especially the Middle and Far East, has led to significant increases in direct demand for maize as well as derived demand from meat production. In addition, high energy prices have led to an increase in the production of ethanol from maize, especially in the US.

The largest maize consumers, based on expected 2012/2013 figures, are the US at 282,5 million tons (31,4%); China at 201 million tons (22,3%); Europe at 69,5 million tons (7,7%); and Brazil at 56 million tons (6,3%). World maize consumption is expected to increase by 3,6% (31,5 million tons) this season compared with 2011/2012’s 869 million tons. But lower economic growth and higher prices could lead to a lower figure.

Imports: Total world imports of maize are projected to increase slightly by 0,5% to 97,46 million tons from 2011/2012 to 2012/2013. Japan is the world’s largest importer of maize, and is expected to increase imports by about 3% to 15,5 million tons. The second-largest importer is Mexico (9 million tons), which is one of only a few countries that import white maize. Next is South Korea, with imports of about 8,5 million tons) (8,7% of world imports).

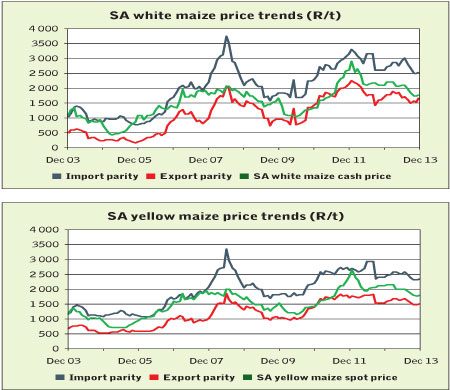

Price trends: On several occasions during the past year, world maize prices traded at levels well above US$300 (about R2 500 at present exchange rates). To put these higher prices into perspective, it should be noted that world maize prices traded for a fairly long time at levels close to or even above those of wheat. Over the long term, wheat typically trades at a premium of between US$30 and US$50 above the price of maize. That premium is currently between zero and US$15.

Prices on the Chicago Mercantile Exchange (CME) are trading above US$8/bushel (bu) (R2 576/t), up from US$6/ bu (R1 932/t) earlier this year. But CME prices could increase to levels of near US$10/bu (R3 220/t) if the present poor growing conditions persist.

.jpg)

World maize market outlook

With world production close to consumption this season, stock levels are expected to stabilise, but could decrease to levels below 125 million tons again if production conditions deteriorate further. This compares with last season’s stock levels of 127 million tons. If stock levels do decrease further, prices will probably trade higher towards the end of the season.

Higher prices will lead to a decrease in consumption, with the price of maize still higher relative to the price of wheat.

In some cases, maize will be replaced by wheat, especially for feed. Over the longer term, any reduction in demand for ethanol will lead to lower demand for maize and negatively affect maize prices. It should be remembered that natural gas remains a cheap source of energy, and its use will probably increase in the next five to 10 years. This could lead to ethanol being replaced with natural gas.

Domestic maize market trends

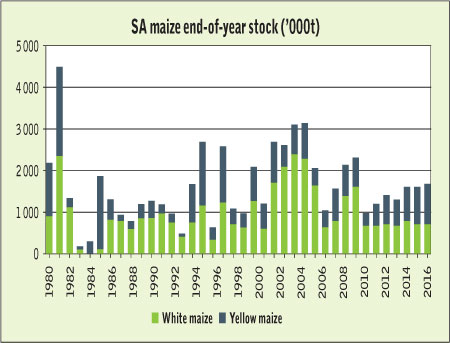

The SA 2011/2012 maize production season had a difficult start. Early spring rains led to some farmers planting part of their crops much earlier than normal. Early to midsummer drought then put pressure on the crop, leading to unfavourable growing conditions. In addition, low prices early in the previous season resulted in more exports than initially anticipated.

Exports to new destinations, such as Mexico, led to lower-than-expected white maize stocks, and white maize was imported periodically from Zambia to ensure that millers did not run out of stock. Maize production for 2011/2012 is estimated to be 10,8 million tons, with stock levels remaining at nearly 1 million tons, before increasing to levels closer to 1,5 million tons again.

White maize: Local white maize prices will continue to follow international prices closely. SA is one of only a few countries growing white maize, thus the local white maize price is closely linked to the yellow maize price and will trade at a premium or discount, depending on supplies, to local yellow maize. Local production of white maize is estimated to be 6,1 million tons, while local consumption is estimated at 5,4 million tons.

Estimated exports for 2012/2013 are just above 1 million tons, but could decrease due to a smaller harvest. In terms of total maize crop, this, together with the increase in yellow maize production, should result in a break-even position (excluding initial stocks) – a turnaround from last season, when local demand plus exports left a shortfall of 1,37 million tons. Currently, prices are trading at about R2 700/t, 46% higher than the same time last year. A decrease in the strength of the rand against the US dollar could drive prices even higher.

Yellow maize: Domestic prices will continue to follow international prices. Currently, the local yellow maize price is trading above export parity, but prices may move closer to export parity in the short term due to the US drought. The average weekly yellow maize price is currently at the R2 700/t level, 46% higher than a year ago and 137% higher than two years ago.

Domestic maize market outlook

As noted, maize production for the 2011/2012 season is expected to be about 10,8 million tons. Although this could provide for local needs, stock levels are still expected to remain at about 1 million tons, depending on the size of the crop and exports. This is likely to result in prices closer to import parity. However, the movement of the rand against the US dollar will also affect the maize price.

Local demand is expected to remain relatively constant in the near future. In the longer term, new broiler projects in the pipeline might lead to an increase in maize consumption. On the other hand, the construction of soya bean processing plants could lead to reduced maize production, as farmers would probably change to maize/soya bean crop rotation on a larger scale, especially as soya beans reduce the need for nitrogen, cutting maize production costs.

Together, these factors would lead to prices closer to import parity. But this is unlikely to happen overnight, as several of these changes will take time to implement.

Adapted from Absa Agribusiness Maize Outlook compiled by Loffie Brandt. Although every effort has been made to ensure accuracy, neither Farmer’s Weekly nor Absa Bank takes any responsibility for actions or losses that might occur due to the use of this information. Contact Loffie Brandt, Absa’s manager for agricultural information, on 011 350 0667.