Most Popular

Newly released research has found that the milking process could be a factor in the spread of highly pathogenic avian...

Choosing a breed to farm depends on various factors, including the environment in which you plan to farm. Janine Ryan...

How wildlife vets play a vital role in advancing conservation

Besides treating animals that live in the wild for diseases and injuries, wildlife veterinarians such as Dr Johan Marais also assist in introducing animals to new sanctuaries and doing genetic...

Young sheep farmer builds thriving business despite challenges

Luvo Kiyane is not only at the helm of a profitable livestock initiative on a shared state land reform farm in the Elliot district of the Eastern Cape, but also...

Trying to tip the scales in favour of further protection for pangolin

Brian Berkman asks Tswalu Foundation researcher Daniel Rossouw why his study into the positive impact of the pangolin matters and what he’ll learn from it.

Challenges and opportunities expected for dairy production

The US Department of Agriculture recently released its latest report on dairy production in the US, Europe, Australia and New Zealand, and the trends driving trading.

From a DJ to a successful farmer in the Eastern Cape

Lubabalo Ngcwembe (43), from Zwelitsha near Qonce, shares his remarkable journey into farming, overcoming challenges to build Ikhasilethu, a thriving livestock and vegetable enterprise.

The oldest SA Beef Shorthorn herd excels in the coldest place

The Beef Shorthorn is probably as close to a perfect beef cattle breed as you can get, Barry Stretton, owner of the Brotherlea stud in Molteno, told Annelie Coleman.

Managing a Swiss chard crop for a high, ongoing yield

This leafy vegetable is a voracious feeder that requires plenty of nitrogen, and must be protected from frost and eelworm, says Bill Kerr.

Hlobi Yende, the young farmer transforming her family farm

Hlobi Yende is part of a new generation of young, energetic female farmers making waves in the agriculture sector. She is leading the charge by defying stereotypes and creating an...

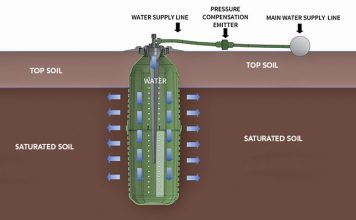

Carrot irrigation should be different

A carrot plant’s fine roots can reach up to 2m deep. Most farmers do not exploit this potential and irrigate more or less the same as they do for other...

Getting the best out of pear orchards

GA Erasmus en Seuns Boerdery in the Western Cape Overberg won the award for the best income per hectare for pears at Two-a-Day Awards Ceremony in 2023. George Erasmus and...

Sunflower production: threatened by stink bugs and fungi

With continuous management of the insects that predate on sunflowers, significant success can be attained with this crop, which is suited to growing in the drier parts of South Africa,...

Managing the domino effect for a quality litchi crop

The process of eating a litchi reveals a greater truth about the fruit’s production: crack the hard part and reap the sweet rewards. While many have opted out of this...

The types of grasses or shrubs that grow on any particular piece of veld will give you an idea of...

Dog trainer Jarred Hodgson says a well-trained dog can be a game changer for farmers in the country.

For Cynthia Sekgobela, retirement in 2016 brought a bold new beginning. After 21 years as an accountant and tax consultant,...

When it comes to protecting your irrigation system, few things are more important than effective filtration. The correct choice of...

Thaba Chweu Municipal property rates court case explained

Len Dekker, senior director at law firm Len Dekker Attorneys, breaks down the recent Supreme Court of Appeal judgment that may be of interest to farmers.

Farm shop with food and entertainment

Jonno designs a farm shop that includes a shisa nyama/braai area; an entertainment hall/restaurant, a car wash and filling station.

A tranquil retreat in the heart of the Swartberg Mountains

Brian Berkman is thoroughly charmed by a nature reserve and its hospitality in the Klein Karoo. Wildehondekloof Private Game Reserve is about 60km outside of Oudtshoorn in the Western Cape...

Espresso chocolate brownies

These delicious brownies can be enjoyed on their own, or with cream and ice cream. Make sure you make a double batch; your guests will be coming back for seconds,...

Easy vanilla panna cotta with white chocolate

While this panna cotta may look daunting, it is actually a very easy recipe that will impress friends and family, says Lorraine Steyl.

Lamb shank parcels

These lamb shank parcels are perfect for a Christmas dinner. They are not only delicious but they look the part too, says Lorraine Steyl.

Butter chicken with peaches

The star of this dish is the creamy and spicy sauce, says Lorraine Steyl.

Slow-roasted, juicy pork belly

Step aside, ham! This pork belly may very well earn its place at your future Christmas feasts, says Lorraine Steyl.