According to Agbiz chief economist Wandile Sihlobo, the rebound was driven by a combination of favourable production conditions, strong export performance, more reliable port operations, and increased optimism around foot-and-mouth disease (FMD) control following the announcement of the nationwide cattle vaccination drive.

“A reading of 67 is well above the neutral 50-point mark, indicating that agribusinesses are broadly positive about operating conditions in South Africa,” he said at the Agbiz Media Day held recently in Pretoria.

The survey, conducted during the last week of November, captured the views of companies active across all major agricultural industries.

Weather and exports set the tone

Producers entered the 2025/26 summer season on the back of ample soil moisture and widely expected rainfall linked to the La Niña weather phenomenon. After a turbulent 2023/2024 drought cycle and global input cost volatility, the return to more stable conditions boosted sentiment across the grain, oilseed, and horticultural industries.

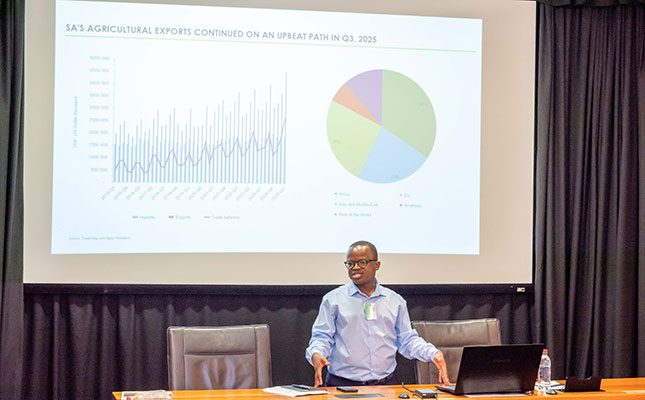

Export performance has been another standout factor. South Africa’s agricultural exports have remained robust throughout the year, despite geopolitical turbulence and shifting global trade rules. Export values reached US$11,7 billion (around R198 billion) in the first three quarters of 2025, up 10% year-on-year (y/y).

Improved port efficiencies – faster container turnaround and reductions in vessel queues, in particular – helped to prevent bottlenecks during peak shipping periods.

FMD vaccination announcement supports confidence

One of the more subtle yet significant contributors to optimism is the renewed national effort to control FMD. For several years, recurring outbreaks have placed pressure on livestock industries and complicated export negotiations.

The nationwide cattle vaccination plan, announced in November, marked a turning point.

“The disease has been a national challenge that, for some time, seemed out of control. The move to vaccinate the roughly 12-million-head national herd, 7.2 million of which are in commercial production, creates confidence that the industry can stabilise in a couple of years,” Sihlobo noted.

Inside the ACI: what changed in Q4?

The ACI is made up of 10 subindices, most of which strengthened in Q4, with only two showing mild declines.

-

Stronger indicators

Capital investment (up 7 points to 74): agribusinesses continued to invest in machinery and equipment. Tractor and combine harvester sales tell the story: 6 122 tractors were sold in the first 10 months of the year (up by 11% y/y), while combine harvester sales rose by 8% to 197 units.

Export volumes (up 32 points to 75): reflecting the strong performance in fruit, grains, wine, and oilseeds.

General agricultural conditions (up 4 points to 71): producers expect La Niña rainfall patterns to support the 2025/26 crop outlook.

Market share (up 11 points to 71): producers across subsectors reported confidence in expanding or retaining market access.

Employment (up 3 points to 53): this aligns with quarterly labour data, which showed that farm employment rose by 2% in Q3 to 920 000 jobs.

General economic conditions (up 3 points to 62): the broader economy is showing signs of stabilisation. Contributing factors include S&P’s credit rating upgrade, South Africa’s removal from the Financial Action Task Force Grey List, and progress made under Operation Vulindlela.

-

Mild declines

Turnover (down 4 points to 71): this dip was driven mostly by winter crop producers facing lower commodity prices despite good yields.

Net operating income (down 6 points to 65): margins remain under pressure in some segments, particularly livestock, where FMD disruptions continue to affect movement and slaughter patterns.

Debt and financing cost subindices: what they mean

Two components of the ACI – financing costs and debtor provision for bad debt – are interpreted in reverse. Lower readings indicate improvement.

Financing costs (up 12 points to 82): this increase is unusual given recent interest rate cuts. It likely reflects the lingering effects of earlier high borrowing costs, as well as the time it takes for lower rates to filter fully into agribusiness financing structures.

Debtor provision for bad debt (down 3 points to 47): the decline signals healthier balance sheets and fewer clients struggling to repay their loans, supported by strong field crop and horticulture harvests.

Outlook: gains uneven, but momentum building

Despite the overall jump in confidence, Sihlobo cautions that not all subsectors are recovering at the same pace. Field crops and horticulture are benefitting most from weather and market conditions, while the livestock industry remains under pressure.

“What will help recovery into 2026 is the speedy rollout of FMD vaccination and the favourable rainfall expected during the La Niña phase,” he said.

He added that long-term growth relies on continued collaboration between government and industry, particularly around stabilising municipalities, addressing rural crime, improving port performance, and ensuring state-owned land goes to capable beneficiaries.

“These structural improvements are essential for sustained expansion in agriculture,” Sihlobo concluded.