How did the agricultural economy fare in 2025?

South Africa’s agricultural economy delivered a mixed performance in 2025, with strong gains in some subsectors and persistent challenges in others.

- Grains and oilseeds: favourable weather supported bumper harvests, including the second-largest maize crop and largest soya bean harvest on record in South Africa. However, high supply drove prices lower, tightening margins despite strong production. Many grain farmers opted to consolidate rather than expand.

- Fruit and horticulture: fruit farmers in the Cape region had an excellent year. Citrus exports were strong despite US tariffs, and stone fruit producers benefitted from improved port efficiency and favourable weather. Table grapes maintained quality and packout percentages, confirming two consecutive good seasons. Net farm income for fruit growers increased year-on-year. Wine producers, however, faced pressure from rising stock levels, although prices held steady.

- KwaZulu-Natal and Mpumalanga: several industries struggled with unstable markets and lower prices, impacting these provinces most acutely. Sugar cane and timber remain under pressure due to weak demand, while macadamia producers achieved improved margins compared with last year.

- Livestock: recovery in the livestock industry is slow, hampered by ongoing foot-and-mouth disease (FMD) outbreaks. Vaccination programmes are under way but will take time to stabilise the industry. Margins remain tight, though feed costs are easing thanks to lower grain prices.

In terms of overall financial viability, most farmers in the Free State, North West, and Northern Cape maintained margins and met debt obligations, reflecting cautious financial management. While crop industries generally performed well, livestock and certain regional industries continue to face significant headwinds.

What are the prospects for 2026?

The global economy has weathered significant uncertainty in 2025, particularly following the announcement of US tariffs earlier in the year. These developments initially prompted widespread concern, leading the International Monetary Fund to revise its global growth forecast from 3,3% in January to 2,8% in April.

However, by October, the outlook improved to 3,2%, underscoring the adaptability of global trade and industry.

Despite the turbulence, the anticipated impact of tariffs did not materialise in 2025, and this resilience suggests 2026 will likely be another year of survival rather than spectacular growth.

South Africa ends 2025 on a stronger footing. A double sovereign rating upgrade has boosted investor confidence, while progress on structural reforms continues to support economic stability.

The rand has benefitted from a weaker US dollar, and Absa Research expects further appreciation into 2026, provided the US Federal Reserve cuts rates more aggressively than the South African Reserve Bank [SARB]. However, if the former delays or avoids rate cuts, rand strength could be capped.

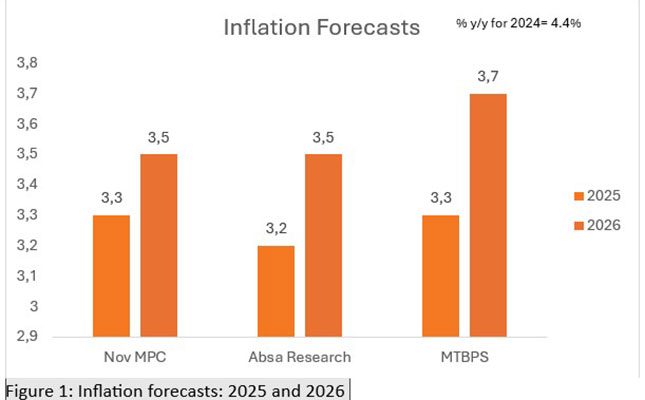

On the inflation front, the SARB remains committed to its 3% target, emphasising the long-term benefits of price stability. Inflation is projected to average below 4%, aided by easing food price volatility and lower borrowing costs. The repo rate is expected to fall below 6,75%, supporting household consumption and improving real disposable incomes. This combination of contained inflation and lower interest rates should provide a tailwind for consumer spending in 2026 [see Figure 1].

Brent crude oil prices trended lower throughout 2025, a welcome development for South Africa as an oil importer. Rising global inventories driven by higher stockpiles in China and sanctions on Russia are expected to keep oil prices under pressure in 2026, reducing fuel costs and supporting transport and logistics sectors.

For commodities, fertiliser prices are set to ease after sharp increases in 2025. Urea prices could decline by about 7%, while DAP may fall by 8%, thanks to new production capacity in East Asia and the Middle East. MOP prices are also expected to moderate. However, this outlook hinges on stable natural gas and ammonia prices, as well as the absence of trade disruptions.

What do you see as the main challenges and opportunities for agriculture in 2026?

The year ahead will be shaped by structural challenges and promising opportunities for South Africa’s agriculture sector. Market volatility remains a concern, particularly for grain and oilseed producers who face tight margins despite strong harvests. Prospects of yet another bumper crop point to lower grain prices.

Livestock recovery will be slow as FMD continues to disrupt operations, while financial vulnerability persists for highly leveraged farmers exposed to rising costs or poor seasons. Global trade uncertainty and potential tariff risks add further pressure on export-dependent industries.

On the positive side, macroeconomic conditions are improving. Lower interest rates and stable inflation will ease borrowing costs and support investment in productive assets. Input costs are expected to decline, with fertiliser and fuel prices moderating, which should improve operating margins.

The fruit and horticulture industries remain well-positioned, benefitting from strong export demand and infrastructure upgrades that enhance port efficiency. Technology adoption offers another major opportunities, enabling farmers to improve resource management and market responsiveness.

What should farmers focus on in the new year to maintain long-term financial viability?

Farmers should prioritise strategies that strengthen resilience and long-term financial viability. A key focus should be on risk management, which includes investing in installing hail netting where feasible, as well as adhering to biosecurity protocols to protect and mitigate against disease outbreaks and the spread thereof.

Cost control and operational efficiency remain critical. Farmers need to be precise and deliberate in managing expenses to sustain margins. Diversification of enterprises is another important step, helping to spread risk and tap into new market opportunities.

Embracing technology and innovation can boost productivity and reduce input costs, with digital tools offering advantages in monitoring and market intelligence.

Exchange rate dynamics will also play a role in shaping farm economics in the year ahead. A stronger rand could exert downward pressure on commodity prices, which may limit revenue potential, but on the positive side, it will ease the cost of imported inputs such as fertilisers and fuel, supporting production efficiency.

Farmers should prioritise financial discipline and resilience in 2026. Overreliance on debt or short-term financing is risky, as cost spikes or poor seasons can quickly erode profitability. Businesses should aim to grow through retained earnings rather than excessive borrowing and avoid financing lifestyle assets that drain cash flow.

Paying careful attention to cost structures is critical, and any unchecked increase in expenses can eliminate margins. Farmers who maintain strong cash flow and reinvest earnings into productive assets tend to be more sustainable.

On the production side, adopting good rotational systems and soil health practices improves resilience and long-term viability. These measures, combined with prudent financial management, position farmers to withstand volatility and maintain profitability.

Get trusted farming news from Farmers Weekly in Google Top Stories.

➕ Add Farmers Weekly to Google ✔ Takes 10 seconds · ✔ Remove anytime