South African consumers invariably blame rising food costs on primary producers – farmers – and those at the end of the agri-food value chain – retailers and restaurants. However, there are many businesses along the value chain that are affected by rising costs and end up passing these on. Sometimes these companies try to negotiate better product prices from lower down the chain; more often, however, they pass additional costs further up.

The fact remains that higher food prices negatively affect national and household food security. The UN Food and Agriculture Organisation defines food security as when all people, at all times, have physical and economical access to sufficient safe, nutritious food which meets their dietary needs and preferences for an active, healthy life. It is not enough for a country to produce sufficient quantities of one or two staple foods in order to consider itself food-secure; its citizens must have access to sufficient diverse foods for good nutrition.

Affordability of food: a global challenge

Costly food

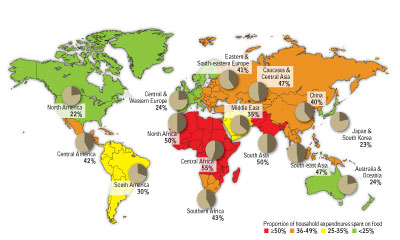

Food affordability has become a global problem, especially in Third World countries, explains Professor André Jooste, senior manager at the Market & Economic Research Centre with the National Agricultural Marketing Council (NAMC). In Southern Africa, people spend an average of 43% of their income on food. In Central Africa, this figure increases to 55%.

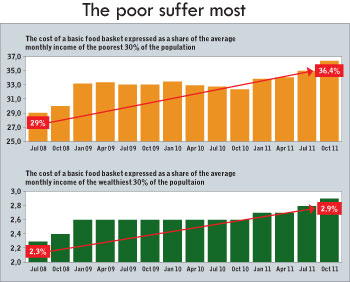

In South Africa specifically, Stats SA found that, in 2005/2006, the average household spent 14,5% of its total income, or R8 105, on food and non-alcoholic beverages over 12 months. Over 2008/2009 this increased to 19,3%, or R13 914. By October 2011, the poorest 30% of the population were spending 36,4% of their total income on food – and this was by no means a big food basket. At the same time, the country’s wealthiest 30% were spending only 2,9% of their total income on food.

The causes

“You can imagine how big an impact even the smallest food price increases have on the poorest 30% of the population,” says Prof Jooste. “In April 2012, inflation for the most basic SA food basket was 8,7%. For the poorest 30% this actually equated to 20,2%. So it’s no coincidence that the subject of food prices is high on our government’s agenda.

“If the causes of high food prices are not understood by government or explained to consumers, there’s the risk that stakeholders in the agri-food value chain can be accused of profiteering. Government must also understand that it too is contributing to high food prices.”

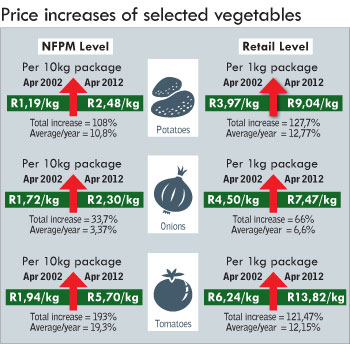

There is a huge price discrepancy between the prices that farmers get for their products – at the National Fresh Produce Market (NFPM) level – and the retail prices. This is largely due to stakeholders along the agri-foods value chain adding ever-increasing input costs. SOURCE: DAFF, STATS SA & NAMC, 2012

For example, according to the NAMC, the current retail gross profit on white bread is R0,91 per loaf. Government’s VAT income from the same loaf of bread is R0,98. According to Jooste, government needs to show an understanding of the agri-food value chain so that it is able to provide solutions to high food prices as well as guide investment in important areas such as research and development.

The poorest 30% of South Africa’s population spend vastly more of their income on food than do the wealthiest 30%. This makes the poor extremely sensitive to even the slightest food price increases. SOURCE: NAMC, 2012

Based on the NAMC’s evaluation of food prices, there are many products that show massive, and ever-widening, price differences between the primary producer and retailer. The reasons for these are not always fully understood, says Prof Jooste.

White maize

In the case of a staple such as white maize, the price of maize meal is currently high because the national price of white maize grain hovers between import and export parity. This is because much of our national white maize harvest from the 2010/2011 summer was exported, creating low national stocks, which in turn led to higher prices for maize grain and hence maize meal.

In South Africa, the maize meal price responds rapidly to the maize grain price. At the same time, explains Prof Jooste, maize farmers’ decisions on how much to plant each summer correlate to the maize grain price leading up to the following planting season. If there is a low maize grain price ahead of the planting season, maize farmers are likely to plant less maize. This leads to limits on maize grain stocks after the planting season – and prices go up.

Increases in prices of selected products

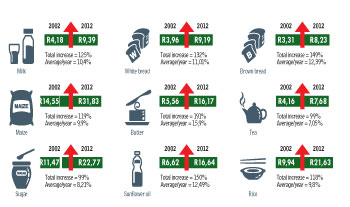

The prices of basic foodstuffs in South Africa have increased dramatically since 2002. This is largely due to significant increases in the prices of inputs all along the agri-foods value chain.

SOURCE: STATS SA & NAMC, 2012

This in turn prompts maize farmers to plant more maize in the following season. In other words, farmers follow the rational supply-and-demand curve with their plantings. “Wheat, on the other hand, operates differently,” explains Prof Jooste. “South Africa never produces enough wheat for its own requirements and hence the domestic wheat price will always be at import parity.”

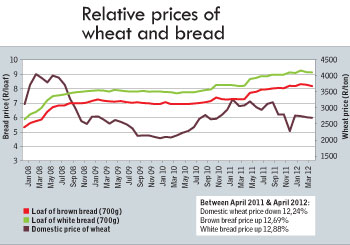

While the maize meal price follows fluctuations in the white maize grain price, this is not so for the wheat-to-bread value chain. Bread prices have stayed fairly stable despite significant changes in the wheat grain price. This is because the two commodities have totally different value chains, explains Prof Jooste.

While maize grain and its products typically go from the farm to the silo, mill and retail point, and have a long shelf-life, wheat typically goes from the farm to the silo, mill, bakery and retail point, and bread has a short shelf-life. In the latter case, the additional stage of baking and the short shelf life both end up affecting price.

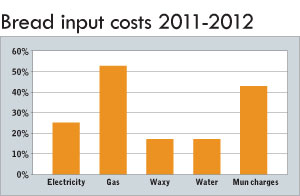

Even the production of a simple loaf of bread – a major staple in South Africa – has been hard-hit by input price increases in a single year. The country’s poorest consumers are struggling to keep up. SOURCE: NAMC, BASED ON INDUSTRY SOURCES, 2012

Lower profits

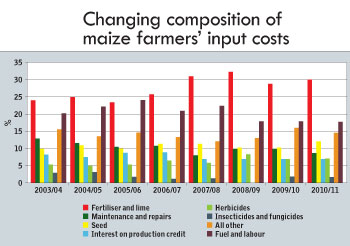

Many farmers are making ever-lower profits from their products, while the retail price for the value-added versions either remains constant or increases. Often, this is due to increasing non-food costs in the chain. “An example of why this gap is increasing is the cost of maize grain production,” says Prof Jooste. “The prices of inputs – fertilisers, fuel and electricity – have increased dramatically in recent years. And this has happened among many other crop types.

“The result is that farmers, who are often price-takers and not price-makers, are generating less profit from their businesses. And if there’s a drought, for example, a farmer might go out of business.” Bearing in mind these commercial risks, and the necessity to produce sufficient, affordable food, Prof Jooste questions why National Treasury continues to allocate less than 1% of SA’s gross domestic product to the department of agriculture. Further cause for concern is the downward trend in the terms of trade at national primary agricultural level.

While bread prices have not seen major fluctuations since January 2008, the national wheat price has fluctuated wildly. Much of SA’s wheat is imported at prices governed by international markets and the rand’s exchange rate. SOURCE: JSE, STATS SA & NAMC, 2012

Put simply, the costs of inputs are rising faster than the value of outputs, which means that farmers’ profit margins are becoming smaller. “We have to ask ourselves: why don’t we budget more money for food production?” he asks. “In Brazil, the agri-food value chain communicated the importance of agriculture to policymakers and obtained the necessary investment in response. Given our national trends, this is something we need to work on,” says Prof Jooste.

Fertiliser, fuel and electricity have consistently been the largest contributors to maize farmers’ overall input costs.

SOURCE: GRAIN SA & NAMC, 2012

Manufacturing

To help explain the price gap between primary producers and retailers, it’s instructive to look at the huge input price increases of manufacturing. Between March 2005 and March 2012, prices of plastic bottles increased by 82,2%, of tinplate by 84,8%, kraft paper by 34,3%, corrugated cardboard boxes by 35,7%, gas and water by 96,3%, electricity by 177,4%, and petroleum and coal products by 121,9%.

Consumers need to appreciate how much packaging contributes to overall food costs, says Prof Jooste. Sometimes the packaging can cost more than the food product it holds. Another contributor to manufacturing costs is the old, inefficient equipment operated by many of South Africa’s millers. Logic dictates that these milling companies should re-invest their returns in installing new equipment to reduce manufacturing costs. However, in many cases, these returns are so poor that milling companies cannot afford to do this.

The NAMC has found that retailers too are struggling to manage input costs. A study of a small Southern Cape retailer revealed huge increases in input costs between 2001 and 2011. Water and electricity increased by nearly 600%, banking costs by nearly 500%, pest control by more than 200%, advertising by nearly 200%, and salaries by just over 100%.

In 2001/2002 the retailer’s gross margin was 21% with a net margin of about 12%. By 2010/2011, the gross margin had dropped to about 18% and the net margin to about 6%. “To put this into context,” says Prof Jooste, “if you were saving for retirement, would you be satisfied with just over 5% return on your investment?”

Administered costs

Trends in South Africa’s administered prices also concerned the NAMC. Fuel prices increase continually, as do national product transport costs. Max Braun Consulting Services found that from 2004 to 2011 the running costs for a seven-axle vehicle increased by 168,7%, for a six-axle vehicle, 126,5%, and for a two-axle vehicle, 120,6%. These increases have a significant impact on the product distribution costs of the various agri-food value chains, and ultimately on the consumer.

In 2009/2010, the estimated total electricity consumption cost for primary South African agriculture alone was R1,84 billion. For 2012/2013, this figure could be as high as R3,77 billion. Yet farmers have to somehow absorb this increase as they are not always in a position to pass added costs higher up the agri-foods value chain. And the same input cost increases are in any case being felt all the way up.

According to Prof Jooste, indications are that these input cost pressures in the agri-foods value chain will remain, putting increased pressure on profits and resulting in lower returns on investment. And passing all of these costs to the consumer has negative implications for South Africa’s food security. “It’s a very difficult situation,” he notes. “But there are several options that could help ease production costs and food prices. “Firstly, though, the government needs to put in place the correct, long-term policies.”

Proposed policy solutions

The NAMC’s suggestions include the following:

- Developing South Africa’s biofuels industry

- Providing for electricity co-generation from biomass

- Ensuring strategic, informed support from government to the agricultural sector

- Securing additional channels through which our products can be exported in order to create increased demand

- Placing more South African trade representatives around the world

- Re-channelling social grants into food banks and work-for-food programmes

- Developing the infrastructure for improved, cost-effective agricultural production and processing

- Investing in research and development to improve production efficiencies.

Ultimately, argues Prof Jooste, there needs to be an improved understanding of agri-foods value chains and their relation to economic growth, poverty alleviation and food security. Through exchanging knowledge of these chains, the public and private sectors can learn to know and trust each other, and thus co-operate better. Only by doing so can progress be made in easing the food price burden.

Contact Prof André Jooste on 012 341 1115 email [email protected]. or visit www.namc.co.za.