Photo: Wikimedia Commons

A unique three-way research collaboration between Henley Business School Africa, the University of Pretoria’s Gordon Institute of Business Science (GIBS) and Stellenbosch University recently published new research that cautioned South Africa’s fresh fruit farming industry is facing a perfect storm of challenges that may require a more strategic relationship-driven approach to secure its economic viability.

The industry, which is the biggest contributor to the agriculture export sector by value, has achieved remarkable success.

The largest exporter of fresh fruit in the Southern Hemisphere, the industry generates more than US$3 billion (about R55 billion) in foreign exchange annually and has created over 400 000 employment opportunities throughout the value chain. But rising competition and logistical challenges could threaten the industry’s sustainability, the paper argues.

Decaying infrastructure, bottlenecks at ports, rising shipping costs, electricity and water crises, and the lingering effects of the COVID-19 pandemic lockdowns are among the key challenges outlined in the white paper.

According to the lead author of the research, Prof Daniel Petzer, head of research at Henley Business School, these obstacles not only hinder logistical efficiencies but also jeopardise South Africa’s global competitiveness.

“While South Africa has a wide export reach (Russia and the EU are our biggest buyers of fresh fruit) and our prices are competitive, pressure from fellow Southern Hemisphere producers, namely Chile and Peru, which share the same winter window, are threatening to grab market share. Should our production slip, or our relationships with key buyers fray, these competitors will be ready to step into the gap,” he says.

The white paper stresses that in this terrain, establishing and nurturing long-standing relationships with foreign buyers, as well as diversifying trading partnerships, are essential strategies for growth.

“Our research highlights the importance of investing in strong relationships with both existing and new markets,” says Prof Marianne Matthee from GIBS. “We set out to understand more about what drives successful exporter-importer relationships and export performance and sustainability. Surprisingly, empirical research in this critical area is sparse and we set out to plug this gap.”

A snapshot of SA’s fresh-fruit exporters

The researchers surveyed 65 direct exporters of fresh fruit in South Africa, looking for the behind-the-scenes inter-firm relationship behaviours that were the most significant predictors of export performance and sustainable exporter-importer relationships.

On average, respondents had been exporting their fresh fruit for 15 years, and exporting to their largest foreign buyer for 12 years.

Just over 81% of their fresh produce sales were derived from directly exporting to 35 buyers and exporting nearly 27% of their products to their largest foreign buyer.

While most exporters surveyed perceived their export performance as satisfactory and sustainable, the white paper highlights the need for increased investment of time and energy in the largest foreign buyers, who play a crucial role in long-term export sustainability.

On average, exporters devoted around 14 hours per week to business affairs and communication with their largest foreign buyers.

Five recommendations for success

The research recommends five ways in which fresh fruit exporters in South Africa can enhance their export performance and sustain their relationships with importers, even in difficult times.

First, it recommends that exporters prioritise the economic viability of their exporter-buyer relationships and use sales and profitability measures to measure this objectively.

This would require a willingness and ability to engage with buyers to discuss minimum order quantities and frequency of orders in a frank way.

Second, it urges exporters to take a long-term view of relationships with foreign buyers and not be swayed by short-term gains that could compromise long-term sustainability and profitability.

Third, it suggests that exporters retain open communication with foreign buyers; frequent and candid information-sharing and consultation is crucial, and exporters can work to ensure that lines of formal and informal communication remain open to engage regularly in listening, sharing, planning and problem-solving.

Fourth, exporters can screen and/or train staff to ensure high levels of relationship proneness, which is identified as a key driver of both export performance and sustainable exporter-importer relationships.

For example, ‘soft skills’ and emotional intelligence workshops could boost employees’ desire and ability to forge mutually beneficial relationships with foreign buyers.

Fifth, on a management level, leaders also need to ‘walk the talk’, the researchers suggest. Exporters can foster a relationship-centred business culture that is upheld by management.

“Building a relationship-centred business requires long-term planning and investment both in financial assets and in human capital,” says Dr Stefanie Kühn of Stellenbosch University, adding that it is clear that South African exporters themselves understand the value of this approach.

“It is noteworthy that non-economic satisfaction, commitment, communication, and co-operation emerged as key drivers of sustainable exporter-importer relationships in this study. This is a testimony that the exporters we surveyed value working closely and effectively with their foreign buyers in the interests of both parties.”

Citrus

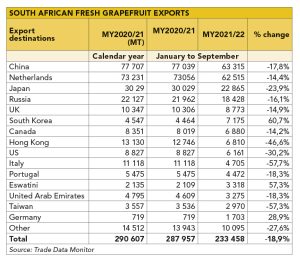

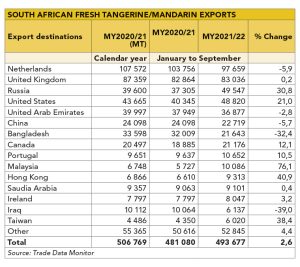

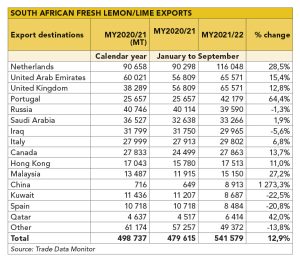

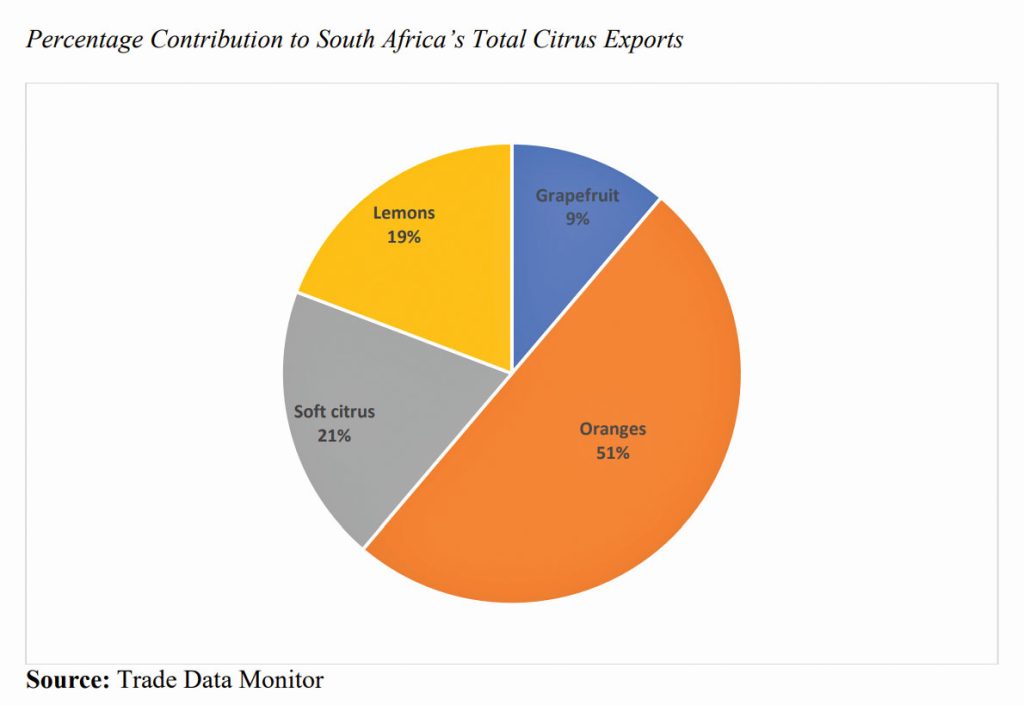

Citrus is a major contributor to South Africa’s exports, generating around US$1,93 billion (about R35 billion) in revenue, according to a 2021 OEC report. Despite this, the citrus industry has experienced significant challenges over the past year, particularly as it pertains to exports.

The introduction of the EU’s false coddling moth (FCM) regulations mid-season 2022, for example, has had a major impact on exports. Production declines, due to load-shedding, drought and skyrocketing input costs, amongst others, have also been experienced.

Despite this, the industry remains an important exporter on a global scale. According to a March 2023 report published by The Fruit Portal, lemon exports were expected at 37,3 million 15kg-equivalent cartons, up 2,6 million cartons from 2022.

The increase was attributed largely to younger trees coming into production. The majority of lemons exported in the 2022/23 season was to the Middle East (49% of total volume), Asia (22%) and Russia (18%).

Navels will see a drop in exports by 2,5 million 15kg-equivalent cartons, with 25,3 million cartons predicted to be exported. Valencia exports were expected to be marginally up by 700 000 15kg-equivalent cartons, with 54,5 million cartons expected to be exported.

In terms of grapefruit, 12,7 million 17kg-equivalent cartons are expected to be exported, down 2,1 million cartons from the 2022 volume.

Tangerine and mandarin exports were projected to grow 8% to reach 560 000t. However, the EU is historically South Africa’s biggest market for this product, and new FCM regulations could come into play during the season.

At the very least, exporters will see a decline in profit margins as they attempt to adhere to the regulations.

Read the full research paper here.