Many South African red meat producers are keen to benefit from exporting some or all of their products to more profitable international markets. To do so, however, these farmers have to identify, and then consistently meet, a variety of requirements.

For a start, a red meat exporter needs to know and understand the current state of South Africa’s red meat trade in fresh and frozen products, half and whole carcasses, and bone-in and deboned cuts.

South Africa is a substantial net importer of mutton and lamb. Nonetheless, there is still an opportunity to increase its exports of sheep meat, as well as live sheep. Kuwaiti company Al Mawashi has already bought and successfully exported around 170 000 live sheep from South Africa since late last year.

South Africa is a net exporter of beef, but also imports relatively large volumes of this meat. This means that there is effectively a national oversupply of beef and it therefore makes sense to increase exports.

Why export?

There are various reasons why South Africa’s red meat industry should export some of its production. The first is that export markets can offer price premiums over the sometimes constrained domestic market.

However, a South African exporter needs to differentiate between working actively to export to premium-priced markets, such as the US, UK and Europe, and exporting simply to get rid of excess production at possibly less attractive prices, such as to various African countries and the United Arab Emirates.

A key challenge is that some premium-priced export markets for South African

red meat are unavailable, or relatively limited, due to concerns about the health status of the national herd and flock resulting from outbreaks of foot-and-mouth disease.

Most of South Africa’s current red meat exports to less price-attractive markets appear to be a means of selling excess produce, especially of beef, that the local market cannot absorb.

In 2019, for example, South Africa exported 24t of topside beef cuts to Kuwait and received R66/ kg for the shipment. By comparison, whole-beef carcasses at the time were priced at an average of R42/kg.

The price paid for the exported topside beef, which is considered a higher-value, boneless cut, also had to cover the exporter’s costs of getting the shipment to Kuwait. According to my calculations, this transaction could not have been more profitable for the exporter than selling to the domestic market.

Competitiveness and quality are key

If a South African red meat farmer wants to enter the export market, his or her products must be competitive in terms of either price or quality. Comparing South Africa’s average red meat prices with those of premium-priced export markets, it is clear that South Africa can be highly competitive.

Again, however, the borders of these countries are currently closed to red meat exports from South Africa.

In countries where average red meat prices are slightly lower than those in South Africa and whose borders are open to South African exports, there are opportunities for local farmers to sell their red meat at a premium if they can provide better quality than these consumers are usually exposed to.

However, both the good quality and the availability of these exports will have to be consistent.

A problem can arise, however, from the regular variations in average domestic prices of red meat at particular times of the year. For example, a red meat exporter might have products available for sale when domestic prices are significantly more attractive than prices on an export market.

If a supply agreement is in place with the export market, the exporter is legally obligated to fulfil this agreement, even if it means making less profit.

To avoid this type of situation, a producer should ideally sign a supply contract with an export market for those periods of the year when South African red meat prices are depressed and when prices on this export market are more profitable, perhaps due to seasonally low production volumes in that country.

This can work well when exporting to the Northern Hemisphere. Some countries also require large numbers of live animals for religious slaughter at particular times of the year.

The devil is in the detail

Potential red meat exporters also need to know exactly which types of products a particular market is seeking. Existing trade data for South Africa’s red meat exports is rather vague, classifying the various products simply as frozen or chilled, whole or half carcasses,

and bone-in or boneless cuts.

Yet customers typically require much more detail, such as whether the meat is from grain- or grass-fed animals; what the fat content is; whether it is safe to eat; and whether it is produced conventionally, naturally or organically.

Some of these markets are particular about whether meat should arrive frozen or chilled. Others demand higher-value or lower-value cuts, and South Africa’s red meat producers should understand why this is so.

Learning from Australia

South Africa’s red meat industry would do well to study the packaging methods used by

its Australian counterpart.

These clearly differentiate Australian products from those of other countries at retail outlets. They also provide consumers with informative yet easily understandable details.

For example, they use diagrams of the type of animal that the meat came from.

Australia’s red meat industry has learnt that in the case of export beef, consumers rank packaging label details in the following order of importance: price per kilogram, price per pack, whether or not the meat is naturally produced, and whether or not it has a quality grading or product guarantee. Finally, they take note of the colour of the meat.

In the case of Australia’s exported mutton and lamb, the priority ranking is somewhat different: whether or not the meat is naturally produced, the colour of the meat, the price per kilogram, whether or not it has a quality grading or product guarantee, and the price per pack.

By following a similar approach to packaging, South Africa’s red meat industry could enhance its products’ perceived quality, encouraging consumers in export markets to pay a premium.

One reason that Australia’s red meat sector is able to achieve this detailed understanding of the needs of each export market is that it has permanent offices in most of these countries.

The staff conduct frequent market research to ensure that Australia’s red meat exporters provide exactly what consumers in these countries want and can afford. This research also keeps Australia’s red meat industry informed about whether or not it is profitable for the industry to continue exporting to a particular country.

Assuring the safety of red meat

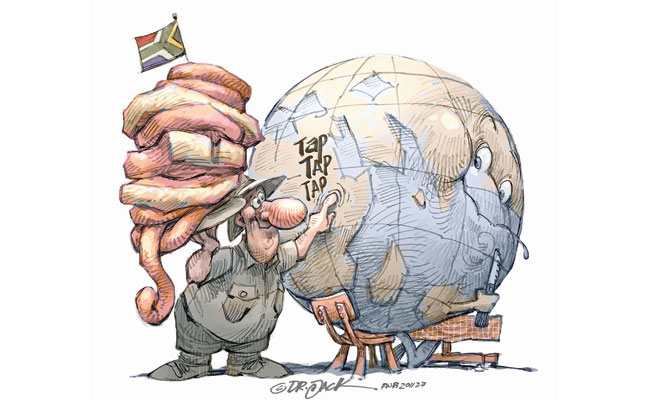

Establishing a strong and mutually trustworthy trade relationship with an export market is vitally important to South Africa’s red meat industry.

When representatives of this country’s red meat industry visit an export market to negotiate or conduct trade research, it is crucial that they immerse themselves in, understand, and strictly adhere to, the business and other societal norms of that country, even if these are very different to those back in South Africa.

This would go a long way towards gaining the trust of trade partners in the export market, as well as helping the representatives of South Africa’s red meat industry to better understand and meet the needs of consumers in that particular market.

It should be remembered that countries importing South African red meat products are becoming increasingly sensitive to the risks posed to their economies and to consumers by diseases that might be carried by red meat products from South Africa.

We have already seen how some countries immediately closed their borders to South African red meat because of foot-and-mouth disease outbreaks here.

To assure foreign governments and consumers of the safety of these products, the South African government and red meat sector need to work together urgently to significantly improve on-farm and national biosecurity, and implement an effective traceability system in the national red meat value chain.

Support and funding required

Perhaps what South Africa needs is an equivalent of Meat & Livestock Australia to manage its red meat exports and related trade relationships.

It might not be necessary to create a new organisation within the current organised agricultural network, because one of the existing organisations could take over the function. But whether new or existing, this organisation would require strong support and funding from the South African government and red meat industry, and would need to operate properly.

The ultimate aim of this organisation would be to prevent problems that could lead to export markets returning South Africa’s red meat products and then cancelling future red

meat imports from this country. Such complications would be economically devastating for South Africa’s red meat industry.