A number of articles comparing the return on investment (ROI) of breeding high value game species (mainly disease-free buffalo and sable) with that of beef cattle have been published over the last few years. Without exception, the conclusions were unanimous that the returns from beef production cannot compete with the returns from breeding disease-free buffalo and sable antelope.

Breeding Stock

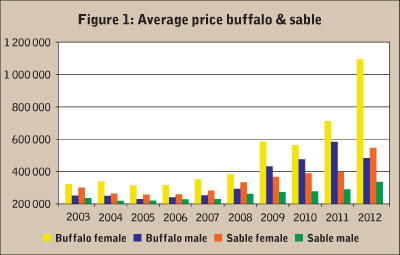

Price trends in disease-free buffalo and sable antelope from 2003 to 2012.

At current prices (see Figure 1), a breeding herd of 10 buffalo (one bull, nine females) and 10 sable antelope will cost approximately R9 million and R4 million respectively. Clearly, a capital requirement of R25 million is a significant entry barrier for potential new participants. However, a recent development is the formation of partnerships or joint ventures where established game ranchers provide the land, infrastructure and daily management of the animals while other investors provide the capital for breeding stock.

Such a collaborative effort enables interested investors to participate and share in the returns provided by an investment in high value game species. On the other hand, landowners benefit from external capital that enables them to improve the ROI in land and infrastructure through a positive cash flow from selling progeny. Of course, a portfolio of shares requires no large, upfront investment as small numbers of shares can be bought at a time, making this form of investment more accessible and affordable for the man on the street.

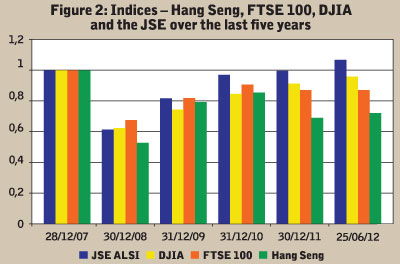

Indices of the four selected stock exchanges (31 December 2007 to 30 June 2012) in local currencies.

Liquidity and Solvability

Nowadays, listed shares can be traded privately over the internet without the need of brokers or other intermediaries.

Since the relaxation of South Africa’s foreign exchange controls, this also applies to overseas equities. An investment in high value game is less liquid, but good quality animals are always in demand and top breeders of buffalo and sable have waiting lists of potential buyers. As with any share investment, new investors should not buy just any animal as they differ in quality.

Better quality animals can be likened to blue-chip shares on the stock exchange. They are in greater demand and generally provide a superior return on the investment. From the perspective of solvability (rate of return on investment over a period of time) the comparison in this article goes back to mid-2007. Following the persistent and exceptional growth in South Africa’s wildlife industry over the last two decades, I feel that the outcome of a 10- or 15-year study would lean even more strongly towards an investment in high value game species.

Risk

A comparison of the risk of a share investment compared to that of high value game is needed. On face value, following developments in the US after the Lehmann Brothers’ banking debacle and the crisis in the Eurozone resulting from the high debt ratios in the PIGS (Portugal, Ireland, Greece and Spain) countries, an investment in high value game in our country appears rather less risky.

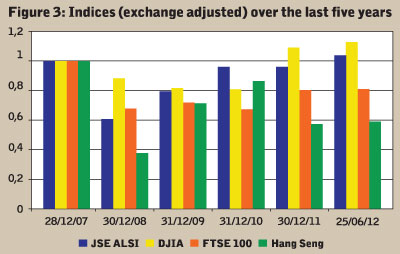

Indices of the four selected stock exchanges (31 December 2007 to 30 June 2012) in ZAR.

As a member of BRICS (Brazil, Russia, India, China and South Africa) South Africa is in a group of countries and trading partners with superior growth prospects compared to those of developed markets. SA’s banking sector is sophisticated and advanced and, given the tight credit regulations and current cash reserves of our banks, a local Lehmann Brothers scenario is unlikely. The single biggest risk to sustainable and viable game ranching has always been land reform and the threat of nationalisation and expropriation.

Although these noises were mostly limited to certain individuals/factions within the ANC Youth League, it created uncertainty among landowners, including game ranchers. At the ANC’s Policy Conference (26 to 29 June in Midrand), the expropriation of land without compensation was discussed at length. The fact that this notion was rejected was a positive development which significantly alleviated the biggest concern of landowners and game ranchers. It should boost investment in high value game, land, fencing and farm infrastructure. It should also accelerate the 8% year-on-year growth we have seen in farm worker employment.

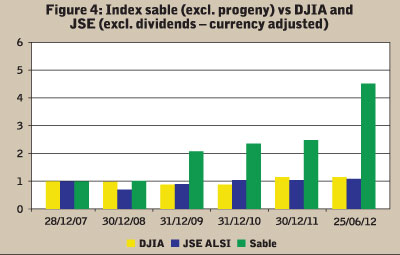

Price index for sable antelope (excluding progeny) versus DJIA and JSE ALSI price indices (excluding dividends).

Stock markets

The JSE All Share Index (ALSI) was less affected by the global 2008 financial crisis and the resultant recession, and recovered far quicker (see Figure 2). In fact, it is the only one of the four selected stock exchanges currently trading above the pre-2008 stock market crash level. In local currencies (at the time of writing), the Hang Seng, FTSE 100 and Dow Jones Industrial Average (DJIA) were respectively trading 31%, 13% and 2% below 2007 closing levels while the ALSI was trading 14% above its December 2007 closing level.

For the South African (or rand) investor, overseas stock exchanges must be adjusted by currency movements over the same time horizon. With all four stock exchanges converted to rand, only the DJIA compared favourably with the JSE ALSI due to the depreciation of the rand against the dollar over the last five years (see Figure 3).

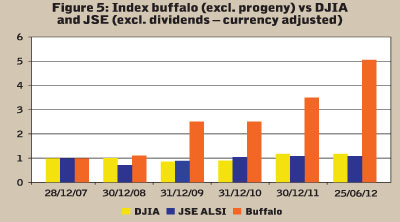

In rand terms, both the Hang Seng and FTSE 100 are even worse off as a result of the rand’s appreciation against the British pound and Hong Kong dollar. The extent by which the average prices of sable and buffalo outperformed the two better performing stock markets over the last five years is illustrated in Figure 4 and Figure 5.

Conclusion

Once the board of directors announces annual dividend payments, the return on investment for a portfolio of shares is easy to calculate. Although dividend yields were excluded from this comparison, they are generally below 3% and would not make a big difference to the overall performance of a share portfolio. Calculating the ROI for an investment in high value game is somewhat more complicated as the capital required for land and infrastructure, as well as operating costs (labour, feed, utilities and others) must also be considered.

Price index for buffalo (excluding progeny) versus DJIA and JSE ALSI price indices (excluding dividends).

The above comparisons also exclude the significant cash generating contribution from the sale of offspring of the original breeding stock. Unlike the value of the dividend yield from a portfolio of shares, the market value of the offspring produced over a five-year period will significantly improve the ROI of an investment in high value game. Through the simple price growth comparison above, it is clear that an investment in high value game over the last five years has substantially outperformed the stock markets.

Over this period, average selling prices of buffalo and sable antelope grew by 540% and 479% respectively, while the comparable returns for the JSE ALSI and DJIA were 14% and 16% respectively. How long this positive trend will continue remains to be seen but it certainly provides for and interesting discussion around the braaivleis fire.

Contact Johan Rabie on 082 555 3367 or at [email protected]