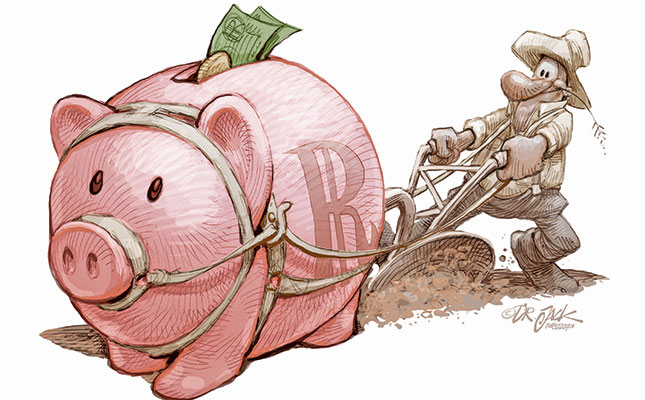

Photo: Dr Jack

South Africa’s farmers have had to contend with extreme weather conditions and increased electricity, fuel and labour costs. The Russia-Ukraine war has also put further significant pressure on production inputs, export markets and commodity prices.

Russia is a noteworthy market for South Africa’s citrus exports as well as apples and pears, and is the world’s leading exporter of fertiliser materials in value terms. This has resulted in a [further] spike in the cost of fertiliser, which is critical to crop performance and, ultimately, yield.

What’s more, over the past five years, South Africa has imported around 30% of its wheat from Ukraine and Russia. And while we still have other trade partners, we need to boost local production as much as possible to help offset rising food prices.

Against the backdrop of these complex challenges and sometimes conflicting priorities (maximising yields, bolstering food security and creating jobs), farmers are also expected to minimise their environmental impact. Essentially, this means trying to introduce sustainable agribusiness practices that are aligned with acceptable environmental, social and governance (ESG) frameworks without compromising yields and profitability.

Aligned with development goals

A recent World Wide Fund for Nature South Africa report, ‘Climate Change Investment and Finance Opportunities in South African Agriculture’, emphasises that financiers have an obligation to provide financing that supports a low-carbon and just transition in the agriculture sector.

Ultimately, however, banks should not just finance the transition, but also use their expertise and understanding of the sector to raise awareness about climate risk and build the business case for sustainable farming.

For funders of the agriculture sector, it is also critical that their solutions bolster food security, improve yields, and be closely aligned with the UN’s Sustainable Development Goals (SDGs), in particular SDG 2, which calls for zero hunger, food security and sustainable agriculture, and SDG 12, which calls for responsible consumption and production.

An example is finance products offered by financial institutions, such as Nedbank, for shade netting in the citrus industry, which helps to ensure the efficient use of water and land. This not only increases the amount of produce that can be exported, but also aligns well with SDG 12.

To enable food security and sustainable agriculture, financial institutions need to understand the ebbs and flows of farming, droughts, excessive rainfall, and much more, as well as the fact that setbacks are inevitable. It is also critical that farmers become resilient enough to withstand these challenges and remain competitive.

Of course, from an investment or financing perspective, accurate monitoring and measurement are essential. Traditionally, and in a conventional loan assessment process, the first port of call would be to assess assets on a balance sheet, historical financial performance and cash flows.

However, operational efficiency, when considered from an agricultural perspective, almost always requires that the asset is productive and creates a sustainable income stream. This type of thinking around collateral and security becomes increasingly problematic where smaller, emerging farmers don’t own the land and are therefore unable to offer a mortgage bond as collateral.

As a result, understanding the commodity cycle, the availability of markets and the vital roles that mentorship and partnerships play in these instances becomes critical to the success of a sustainable and inclusive agriculture sector. It is efficiencies and profitability that essentially create cash flow, not necessarily assets.

So, what does the future look like for funders of agribusinesses? While financial metrics are non-negotiable, it is also important to determine how effectively agribusinesses manage their ESG risks. This is where banking institutions can play a vital advisory role by providing expertise and guidance. On-the-ground diligence is one way of monitoring a project or operation, but the use of agritech as a measurement and reporting tool cannot be discounted, especially when it comes to supporting farmers in rural or remote areas.

This includes analysing soil health and yield potential, as well as using drones or apps to assess plant diseases or threats. Satellite imagery is already extensively, and successfully, used to monitor vegetative growth.

It is likely that banks will be proactive in understanding and implementing ESG-linked financing solutions across the spectrum of farmers in Africa. This will include large commercial producers, but should ideally also focus on smaller, emerging farmers.

This is especially pertinent considering that in most African countries more than 30% of GDP is derived from agriculture and related activities, and over 60% of the population is involved in the sector in some way.

With Africa continually gaining momentum and importance as a global contributor to food security, finance solutions aimed at the sustainable and optimal use of soil and water will become pivotal.

The views expressed in our weekly opinion piece do not necessarily reflect those of Farmer’s Weekly.

Zhann Meyer is the head of agricultural commodities at Nedbank Corporate and Investment Bank.