Understanding these simple and general cost input terms will help you to calculate exactly how much your farming enterprise costs you to run.

Input costs include items needed in your production process, such as labour, fertiliser and tractor fuel.

Imputed charges (or costs)

These represent the value of benefits enjoyed by the farm, or an enterprise on the farm,

during a specific accounting period, but without incurring any real expenditure.

They include the estimated rental value of land, or interest on own capital invested in land and fixed improvements owned by the operator, plus the value of unpaid labour and own management.

Total cost (TC)

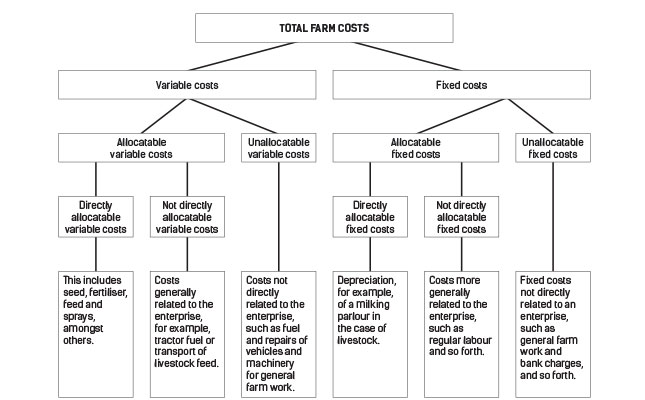

This is the total cost of all resources used in the farming enterprise during a specific year, including stock adjustments and non-cash items. TC consists of fixed costs and variable costs.

Total factor costs (TFaC)

The term, ‘factor’, refers to an input such as raw material, labour or capital, used to produce something or provide a service. ‘External factor costs’ are interest, rent and wages. ‘Own factor costs’ include the farmer’s salary and the notional, or hypothetical, value of items that he/she owns, such as the wear and tear on a tractor. You will need to estimate how much it costs to use the item each year (depreciation).

Total farm cost (TFC)

This is total cost (TC) minus total factor costs (TFaC), but excluding labour.

Variable costs

These are the portion of total costs in direct proportion to changes in the scale of the enterprise within the production system, or if the production farmintensity per unit changes. In other words, variable costs are costs that can be controlled or avoided in the short term.

Fixed costs

These are the portion of total costs that cannot be avoided or controlled in the short term, irrespective of the scale or intensity of production.

Directly allocatable costs

These are the portion of variable or fixed costs that can be allocated to an enterprise without the need for detailed records.

Not directly allocatable costs

Variable or fixed costs that can only be realistically allocated to an enterprise that keeps detailed records.

Unallocatable costs

The portion of variable or fixed costs that cannot be logically allocated to a specific enterprise.

Overhead costs

The portion of the total cost that is not allocated to a specific enterprise, such as the rent paid for leased land.

Interest/financing costs

The amount the farm business has to pay on debts, loans and overdraft accounts.

Cost of hired management

Includes the cost of a paid manager or management service the farm uses.

Cost of regular labour

Includes the cost of regular foremen and labourers, but excludes work by hired management and the farmer and his/her family.

Unpaid family labour costs

Based on the time spent on manual work by family workers, including the farmer and his/ her spouse, who do not receive a regular wage. They are based on the appropriate hourly wage paid to workers for similar work.

Marketing costs

All direct and indirect costs incurred in marketing a product.

Source: ‘Some agricultural economic concepts’, Department of Agriculture, Forestry and Fisheries.