Consumer demand for dairy products is decreasing.

The joint organisation for the dairy industry, Milk South Africa, recently published a report on the retail sales of dairy products, based on surveys by the Nielsen company and compiled by the dairy processing industry’s organisation, SAMPRO.

READ How a top dairy farmer is mitigating high input costs

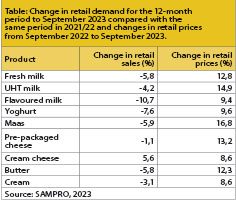

In the 12-month period to September 2023, the retail demand for all dairy products, with the exclusion of cream cheese, decreased 1,1%–10,7%.

Prices of dairy products increased from September 2022 to September 2023 by between 8,6% and 16,8% (see table).

The sharp increase in retail prices led to the retail sector being able to maintain, and in some cases increase, retail turnover.

The sharp increase in retail prices led to the retail sector being able to maintain, and in some cases increase, retail turnover.

Milk processors did not share in the higher retail prices.

According to Statistics South Africa, the price of fresh milk and UHT milk at factory level decreased by 3,8% and increased by 6,9% from September 2022 to September 2023 respectively.

Various factors contribute to the decrease in dairy demand. The sharp increase in retail prices is a major factor.

Retailers increased prices sharply to compensate for lower demand. This clearly illustrates the hold the retail sector has on the total supply chain. Consumers are under pressure.

Interest rates are at the highest level in many years, and food and non-food inflation is high. Load-shedding forced consumers, including lower-income consumers, to spend money on stand-by electricity.

Total expenditure by households increased in real terms by a marginal 0,7% in the nine-month period to September 2023 compared with January to September 2022.

According to the Reserve Bank, consumer debt as a percentage of household income is steady at about 62%. However, debt service cost as a percentage of disposable income increased from 6,7% to 8,8%.

The proliferation of imitation and adulterated dairy products on retail shelves as well as the promotion of non-animal products by retailers and processors affected dairy demand.

Increasing demand

The retail sector managed to increase product prices to the consumer without increasing prices to processors.

Retail prices seldomly move downward but retail process will probably remain at current levels, helping limit the decrease in retail demand.

In 2022 the South African dairy industry spent R24,9 million on consumer education and promotion. This is higher than the amounts spent by the red meat and pork industries individually.

READ Boosting dairy profitability: it’s not all in the genes!

While projects that inform health professionals and educators about the health benefits of dairy products are worthwhile, the real effect on consumer demand is probably not very big. More emphasis on consumers is probably needed.

With its limited funding, the Milk Producers’ Organisation has started a programme to inform consumers of the benefits of South African dairy products.

This programme runs on social media and probably has some impact.

Outlook for farmers

Milk producers received price increases during 2022 and 2023. The decrease in feed prices since the end of 2022 has resulted in improved profitability for dairy farmers.

However, the long period of low profitability has damaged production capacity.

In spite of preliminary indications of slow positive growth in total milk production in September and October 2023, total milk intake for 2023 is still 1,8% less than in 2022 and 1,5% less than in 2021.

The total demand for dairy products will remain sluggish.

In agriculture, input prices increase at a faster rate than product prices; farmers must be able to either produce more with the same quantity of inputs or produce the same quantity of product with fewer inputs.

Dr Koos Coetzee is an independent agricultural economist.