Stakeholders in the grain trading value chain have been laying the groundwork for the contract for four years. Their aim was to develop the basis (cash) market for grain commodities and reduce the market’s overreliance on the JSE Commodity Derivatives Market (formerly Safex) for price discovery.

However, during its most recent advisory committee meeting, the JSE announced it would cancel the basis futures contracts until a new internal software system was in place.

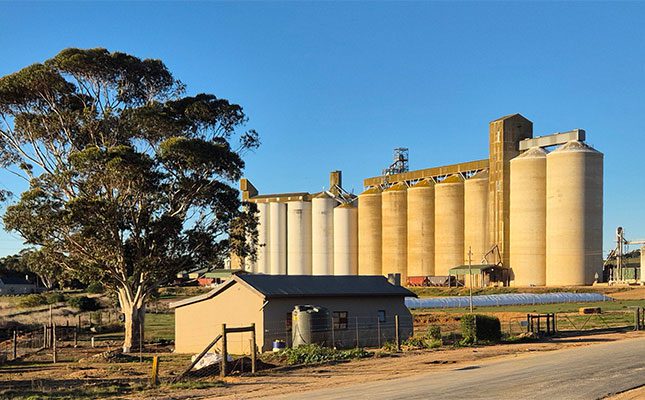

A basis trade contract is the relative difference between the Randfontein-based price and that of a specific silo for a given product such as yellow maize. It is also one of several initiatives recommended by US-based expert Prof Matt Roberts, founder of The Kernmantle Group, to improve efficiency and transparency in the local grains trading market.

Another one of Roberts’s recommendations, a variable location differential, is currently being piloted on soya bean.

According to the South African Cereals and Oilseeds Trade Association (SACOTA), the basis futures contract was cancelled because of the JSE internal legal team’s concerns “regarding the fairness of restricting the new contract to only 10 locations”.

Feedback from the JSE was that maintaining such an arrangement indefinitely may not be lawful or equitable to other storage operators.

SACOTA expressed its disappointment with the decision, pointing out that the basis futures contract “was well known to be a pilot project and that the JSE software had limitations in respect of the number of silos that could be accommodated”.

“Since there is a definite need for this kind of contract in the trade, it means the industry will have to support alternatives,” SACOTA wrote in its latest newsletter, published on 28 August 2025.

Speaking to Farmer’s Weekly, Heleen Viljoen, an economist at Grain SA, said the development of the cash market was sorely needed for greater transparency in grain pricing.

“The futures contract is a derivative product that derives its value from the underlying commodity traded in the cash market. So, a yellow maize contract for July should derive its value from physical yellow maize sold in July.

“Currently, our market focuses more on the futures contract to establish the commodity value than the physical cash market. That is why instruments that develop the basis or cash market are so important,” she explained.

Viljoen said the Grain SA remained hopeful that the JSE would eventually implement these contracts.

“It is very disappointing that these contracts are off the table, because once again we were not able to introduce an instrument to advance market transparency.

The JSE could not give a timeframe for when a software system capable of handling basis futures contracts from all silos would be in place.

“We are in the process of evaluating proposals from multiple system providers. Once a preferred technology partner is selected, details of the project roadmap will be communicated,” Anelisa Matutu, head of commodities at the JSE, said

She added: “The JSE remains committed to ongoing investment in its technology infrastructure and is currently exploring a range of modern solutions to support the commodities market.”

Viljoen said that once the software system was in place, the new contracts would have to be placed on the advisory committee’s agenda, after which the JSE’s legal team would once again have to consider the ramifications.

She added that Grain SA agreed with SACOTA’s view that traders should consider using one of the many private basis trading platforms that have been formed over the past few years.

Get trusted farming news from Farmers Weekly in Google Top Stories.

➕ Add Farmers Weekly to Google ✔ Takes 10 seconds · ✔ Remove anytime