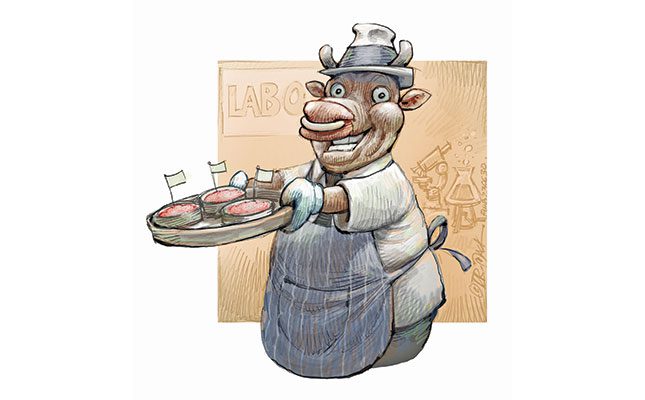

Cell-based meat (CBM) is well-perceived only by niche market or animal activist groups. Other drawbacks of these products are the limited data on their long-term human health implications, environmental impact, and obscure risks related to cellular engineering.

CBM products are not identical to the products they aim to replace. First, there is still dissimilarity at the level of sensory, nutritional and textural properties. Second, many societal roles of animal production beyond nutrition can be lost, including ecosystem services, co-product benefits, and contributions to livelihoods and cultural meaning.

Precision fermentation has been used for decades to produce enzymes for cheese-making or conventional fermentation. Recently, however, companies have used this technology to produce key proteins for the food industry.

Impossible Foods, a company that develops plant-based substitutes for meat products, uses a precision-fermentation form of haemoglobin to give plant-based burgers the look and smell of red meat.

The Every Company makes chicken-free egg products using precision fermentation technology. Companies such as All G Foods and Eden Brew are trying to create liquid milk that contains both the whey and casein proteins needed to give this product the full functionality of cow’s milk.

Fats, sugars, minerals and vitamins must still be added so that these products approach the nutritional content of cow’s milk. As far as meat substitutes go, the envisaged production procedures tend to oversimplify the complexity and growth of skeletal muscle.

HIGH COST OF PRODUCTION

CBM products are not commercialised because producing them industrially is still economically unviable due to the considerable cost of the culture media, the need for high-quality facilities, and the capital cost of sophisticated manufacturing facilities. In addition, the use of antibiotics is not permitted.

Moreover, biological systems such as CBM can result in starkly different growth rates. Yeast, for example, can expand over 1 000 times in less than a day, whereas animals cells take over 10 days to achieve similar growth.

The cost of large-scale CBM will be a major component of the final cost of goods, although the development of blended products with plant-based material will help reduce costs and stabilise formulation. Some companies are focusing on culturing fat cells, with the view that they will only need to add 5% of these cells to their formulations to give the product the hint of meat.

Despite the claims of companies, such products are not ready for the market. Only one laboratory-based food product is registered (in Singapore) and has been temporarily available only in limited quantities.

Claims related to nutritional content cannot easily be verified, although sensory properties of meat such as texture, colour, and flavour can perhaps be adjusted with food engineering techniques to create products with similar appearance to meat.

The use of these products in cooking, however, may be limited, as their characteristics may change during further processing, such as heating and interaction with other ingredients.

Meat contains highly digestible proteins with essential amino acids, vitamins and minerals. While nutrients can be added to meat-replacement products, the cost of this (both economically and in terms of sustainability) is unknown. For example, simply adding components may lead to different bioavailability: the extent and rate by which they are absorbed by the body.

IMPORTANCE OF LABELLING

To be considered meat, CBM must be sourced from an animal, proven to be safe for consumption, and be similar in composition, nutritional value and sensory quality to meat from farmed animals. For CBM to be considered a novel food (within EU legislation), it should be safe and properly labelled so as not to mislead consumers.

From a biological point of view, meat is the final product of aged muscle. The current cellular agriculture process, however, produces muscle fibres and cells, not meat. Consumers who are familiar with what meat represents within their culinary and agricultural legacies tend to avoid calling substitutes meat, unlike vegan activists, who see it as a strategy to eliminate meat from the food system.

The fact that the technology risks are under the control of multinational corporations (based on patents and high technological, economic, and legal entry barriers) may also lead to the creation of luxury foods and cause a further expansion of food deserts in poorer countries.

Finally, the acceptability of CBM is often overestimated as it is based on willingness to try it, not on intention to eat it regularly. Surveys confirm that respondents who express a high acceptance tend to be young, urban and highly educated, have little factual knowledge about CBM production, and are already inclined to reduce meat consumption.

Older, less urban consumers are more reluctant and express concerns about the future of the countryside, livestock farming, and landscape and pastures. They also highlight the unnaturalness of the product and express a higher emotional resistance. Willingness to pay is low overall, as most respondents (68% in France, 71% in Brazil, and 86% in China) were willing to pay less for CBM than for conventional meat.

The views expressed in our weekly opinion piece do not necessarily reflect those of Farmer’s Weekly.

This article is based on a journal article by P Wood, L Thorrez et al, ‘Cellular agriculture: Current gaps between facts and claims regarding cell-based meat’, published in April 2023 in Animal Frontiers, 13(12) 68-74.

Email Prof Paul Wood at [email protected].