Weakening terms of trade

The ratio between input prices and the price farmers receive for their products is steadily narrowing. Farmers must take this into account in future plans.

Changed maize market outlook

The probability of producer prices remaining at current levels, or even increasing somewhat in the next year, remains strong.

Putting a price on goodwill

When a business is sold, there’s an important intangible element, over and above the assets of the company and the income stream, that has to be taken into account.

Making a mess of succession

Managing employees and managing family are two very different jobs. Have you got the skills for both?

Your gateway to Europe

Farmers looking at international diversification of their farming operations should look to Switzerland as a platform from which to trade.

Co-operate or struggle on

In a monopoly, one seller faces many buyers. In a monopsony, one buyer faces many sellers. Farmers have to deal with both – but there is a solution.

Compensation for lessees

Why both parties need expert legal advice in drawing up a leasehold agreement.

African markets key for SA farmers

If the euro weakens, South African farmers may see lower prices, but they mustn’t forget the vast potential of other developing countries in Africa.

Image matters

Successful people recognise that projecting the right image is the first step towards opening doors and making others sit up and listen.

Privatise it!

A radical idea that could lead to safer roads, wealthier municipalities – and tax savings.

Will you share in the riches?

All indicators point to a long-term agricultural boom. There are ways farmers can benefit from this.

Get e-literate or get left behind

The social media wave provides an opportunity for agriculture to win hearts and minds.

Protecting your heirs

When it comes to important ‘personal’ documents, such as wills and antenuptial contracts, be sure you agree with all the clauses before signing.

We need answers!

It’s high time the department of agriculture drops the rhetoric and gives us a few straight answers to questions about our animal bio-security.

The social media opportunity

Although the cellphone opens up a new world of communication, it’s a

small part of the ‘e-options’ available these days.

Who is fooling who?

Who will foot the bill for government’s extravagance when SA’s taxpayers leave to pay tax in countries that appreciate their efforts? It’s something Gordhan and his sidekicks need to bear in mind.

More research, more food

Some 27 countries in Africa will need help with food security in 2012. To meet this demand we need more government-funded research in SA.

Got no time for Facebook? Think again!

There’s power in social media, yet many businesses consider social networking sites as ‘toys’ of little value.

Registering as a VAT vendor

This is a big step to take, but the rules involved are fairly easy to understand.

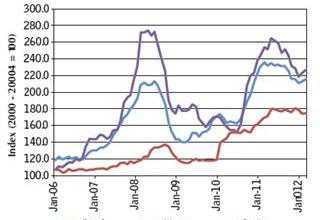

World food prices drop slightly

What goes up, must come down, but farmers must be careful not to make long-term decisions based on the current short-term drop in world food prices.

- ADVERTISEMENT -

- ADVERTISEMENT -

MUST READS

- ADVERTISEMENT -