Albert Basson, chief investment officer at Spitz Capital, an investment fund managed by Namibian firm Königstein Capital, referred to Namibia’s 150ha blueberry industry as ‘little Peru’ during a panel discussion on Southern Africa’s blueberry prospects at the International Blueberry Organisation Summit in Cape Town in late September.

Peru’s blueberry industry has grown spectacularly, expanding from 80ha in 2012 to the current 20 500ha, with average annual growth of 65%, according to the US Department of Agriculture Foreign Agricultural Service.

Since the first blueberries were planted in Namibia in 2019, the industry has grown to become the country’s second-largest horticultural industry, after table grapes.

“One thing we’ve got going for us in Namibia is our unique climate. The large difference between minimum and maximum temperatures gives us exceptional fruit quality. This is nice, but like a car with a lot of horsepower, it takes skill to keep it under control,” Basson said.

Königstein Capital is also strategically involved in Angola, and Basson said the company was likely to follow a similar approach there to the one it used to establish blueberry operations in Namibia.

“A big advantage we have in Namibia is that our trucks drive on tar roads from the farm gate to either Cape Town harbour or (OR Tambo) International Airport, or Walvis Bay harbour or Namibia’s international airport,” he added.

He said the country’s infrastructure made the blueberry industry scalable.

The fact that Namibia is so sparsely populated also makes it easier to obtain land than in many other African countries. Unlike in South Africa, the industry does not have to compete with a large number of agricultural commodity exporters to get the attention of the relevant government officials to negotiate market access to key export markets.

Basson said the industry’s goal was to get to 10 000ha, but there as potential to grow to as much as 20 000ha.

He added that the industry looked to serve the world market during weeks 26 to 38, complementing the volumes Peru supplied, but noted that the Namibian industry would most likely look quite different from that in South Africa, which was dominated by family businesses.

“The reality of where the [Namibian] industry is now and where the appropriate skills and knowledge [to drive the expansion] will come from will most likely be institutional, corporate farming.”

Basson said such enterprises would be advantageous for Namibia for the knowledge, skill, capital, and experience they would bring.

The panel discussion also included representatives from South Africa and Zimbabwe, with talks on regional collaboration to capitalise on high-demand periods in the global market.

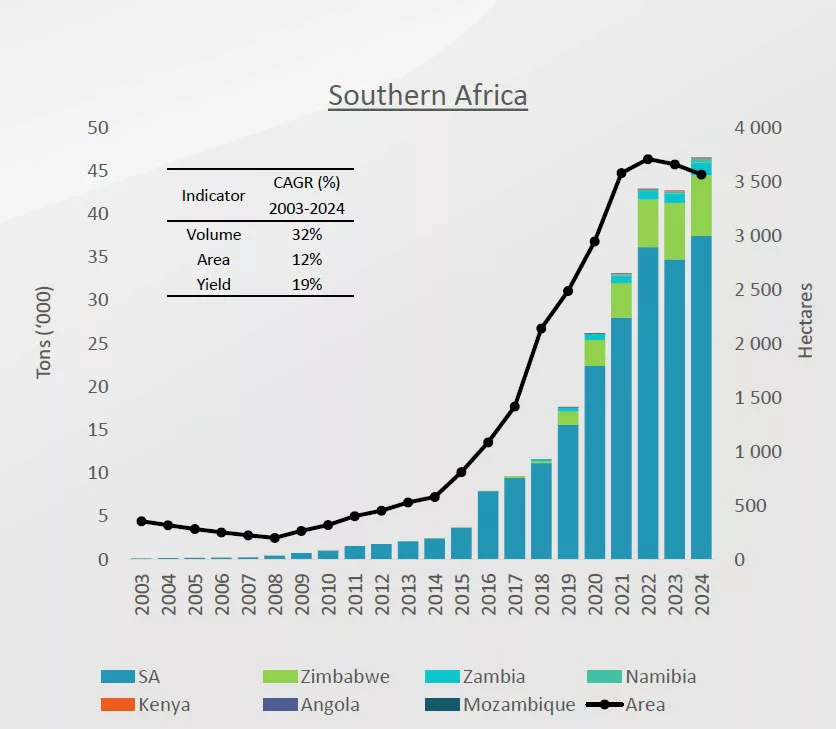

Research conducted by Louw Pienaar, senior analyst at the Bureau for Food and Agricultural Policy (BFAP), showed that Southern Africa (including South Africa, Namibia, Zimbabwe, Kenya, Angola, and Mozambique) represented about 10% of the Southern Hemisphere’s blueberry supply.

However, despite strong growth in Namibia and Zimbabwe, the latter of which currently has about 750ha under cultivation, the hectares of blueberries in those countries are still dwarfed by South Africa’s 2 650ha.

Get trusted farming news from Farmers Weekly in Google Top Stories.

➕ Add Farmers Weekly to Google ✔ Takes 10 seconds · ✔ Remove anytime