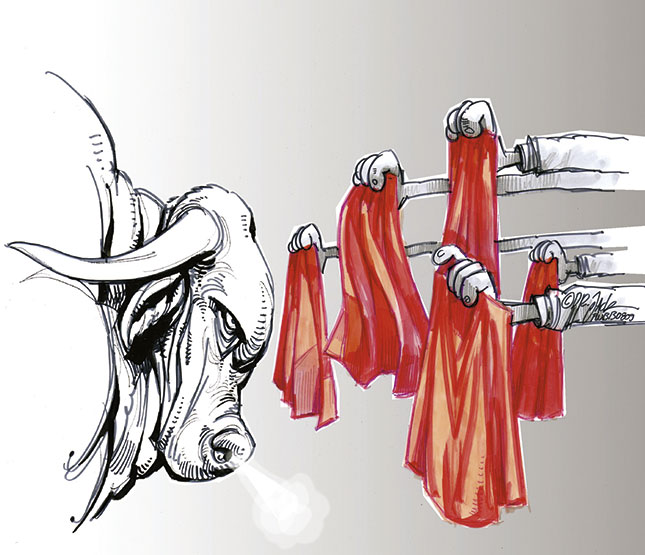

Photo: Dr Jack

While South Africa has what appears to be a thriving beef industry, its average productivity, compared with that of countries elsewhere, shows that it is not achieving its full potential. This is partly due to the low productivity of our informal beef farming sector. This problem needs to be remedied because the South African beef industry is ideally positioned to take advantage of Africa’s increasing middle class expenditure and projected population growth from one billion to two billion people by 2050 – and their associated demand for red meat.

READ:How important is the informal sector in urban food security?

In recent years there have been worldwide improvements in beef feeding practices and herd quality through the use of technologies such as genomics. By and large, these have failed to find their way into South Africa’s informal beef farming sector. This must be remedied. Due to several factors, including environmental concerns, the national beef herd cannot realistically be increased, and existing production efficiencies therefore need to be improved.

Industry pressures

Escalating production costs, intermittent drought, livestock disease and increasingly stringent food safety legislation are pressuring beef farming supply and profitability, so international beef prices are likely to remain buoyant. In addition South Africa’s beef industry is constantly affected by external factors such as the fluid and unpredictable national political milieu, the recent large-scale labour unrest in the agriculture, mining and transport sectors, and decreases in local foreign investment.

Agriculture also faces the uncertainty of the country’s land reform programme, and the pressure of significantly higher minimum wages. Nonetheless, the Bureau for Food and Agricultural Policy estimates that South Africa’s current annual average beef consumption of about 700 000t, second after chicken consumption of about 1,7 million tons, is likely to increase by about 25% by 2020.

Competition for the beef industry will come mainly from the predicted 48% growth in average annual chicken consumption by 2020. Despite experiencing growth in consumption over the same period, eggs, pork and lamb are likely to remain in third, fourth and fifth places nationally. It is important to note that South Africa’s annual formal beef production and supply projected as far as 2020 falls short of national demand by about 50 000t per annum. Ideally, this shortfall should be met by locally produced beef.

Herd unchanged

While the national beef herd, including cattle in the informal production sector, has been stable at an estimated 13 million to 14 million head, annual national beef slaughtering figures have varied in recent years as a result of factors such as intermittent drought – which forces beef farmers to reduce herd numbers quickly. Beef production and utilisation in South Africa have gradually increased since 1970.

However, the country’s annual per capita beef consumption has gradually declined over the same period from a peak of 26kg in the late 1970s to the current 16,5kg. While the country’s population has grown substantially over the last four decades, meat consumption habits have diversified into other meat types, creating competition for the beef industry.

Since the advent of democracy in 1994, the country has seen a rapid rise in the growth of middle- to upper-class black citizens with a parallel increase in the disposable income of this socio-economic group.It seems that expenditure priorities will take a while to catch up in increased consumption of beef, particularly the more expensive cuts. The black middle-class still seems to favour cheaper products, such as chicken.

Prices static, inputs up

In recent times, beef weaner producers have received the same prices that they were paid in 2007. In addition, liveweight weaner prices are currently lower than carcass prices at 56% dressed out. This shows a negative meat margin, which means that any beef farmers slaughtering young cattle are currently losing money. A weaner calf should be about 62% to 62,5% of the price of an A2 carcass. At the moment, however, a calf costs only 55% of the A2 carcass price, an indication that feedlots are getting their weaners at lower prices relative to the price of the meat they sell.

Priorities

Presently, South Africa’s beef production model prioritises maximum productivity at the expense of sustainability, product quality, the environment and animal welfare. Consumer pressure is demanding change, and beef producers will need to adapt. If they fail to do so, traditional beef consumers are likely to move towards other more ethically and sustainably produced meat types.

Marketing

Beef farmers who are making an effort to produce beef in a more ethical and sustainable manner must ensure that consumers are aware of this. Change can only be achieved through effective and honest branding and marketing. This appears to be lacking in South Africa – to the detriment of beef farmers. Most beef products have vague generic branding that does not inspire consumers to appreciate the efforts that are going into producing beef more ethically and sustainability.

Branding can be breed-specific, as illustrated by the country’s Angus breeders, who work hard at differentiating the beef of this breed. Other meat industries are conducting surveys on why consumers prefer certain types of meat. South Africa’s beef industry should be doing the same and promoting the versatility and good qualities of beef. Consumers need to be sure of consistency and quality when they buy beef and the beef industry needs to improve its market-share among consumers.

Information

Accurate figures on national herd size, breeding cow numbers, scales of beef production, production costs, health issues, market factors and other factors need to be collected. This information should be gathered and disseminated by the government. South Africa’s beef farmers often have to rely on unofficial resources for information that could help them improve production methods. Small-scale rural black beef farmers, with minimal access to formal communications networks, have little to no information that could help them improve productivity. Farmers will not know what to work towards if they do not have the correct facts.

Developing beef farmers

Obviously, if demand for beef is increased, the supply of local beef must be stimulated, particularly from developing farmers. Calving and weaning percentages must be increased through improved infrastructure and training and better herd, grazing and livestock health management.

Estimates indicate that South Africa’s informal livestock farming sector has more animals than the formal livestock sector. If, say, beef calving percentages could be increased by 35%, herd composition improved and carcass mass increased, total national beef production could increase significantly. This will greatly improve beef supply and the viability of the beef sector as a whole.

Red tape muffles potential

To take advantage of these potential production increases, access to national beef markets needs to be enhanced though improved distribution infrastructure. Currently there are too many unnecessary rules and regulations for the marketing of beef, and these contribute towards stifling the beef sector’s potential. Moreover, many of these are not policed, so one could ask what the point is of such laws.

South African beef production is also feeling the squeeze due to predation, stock theft and increasing input costs. Yet the real A2/A3 carcass price has not increased in line with production costs. In the short-term, local beef prices may experience further decreases due to high feed costs that exert downward pressure on beef weaner prices.

A shortage of natural grazing in certain areas has seen a number of beef producers reduce their herd sizes and flood the market. However, history shows that beef prices will probably return to normality after the end of this year as grazing improves and beef producers start holding stock back to regrow their herds.

Improved picture

Beef prices may remain sluggish for a while as the economy stagnates. However, the effects of this could be softened by Namibia’s move towards retaining beef weaners for local feeding and slaughter instead of exporting them to South Africa as they have been doing. To take the greatest advantage of any increase in the beef prices, producers must work towards increasing herd efficiencies and producing heavier beef carcasses.”

Contact Jan de Jong on 082 783 9538 or email [email protected].

The author acknowledges Prof Herman van Schalkwyk and Dr David Spies for their data used in his presentation.

The views expressed in our weekly opinion piece do not necessarily reflect those of Farmer’s Weekly.

This article was originally published in the 9 August 2013 issue of farmer’s weekly.