South Africa’s agricultural landscape is as diverse as its cultures, and among the many agricultural crops is sorghum.

Sorghum, a versatile cereal grain, has deep roots in the country’s agricultural heritage, playing a crucial role in both economic and cultural aspects.

READ Maize remains South Africa’s greatest grain

Sorghum offers numerous advantages: it is a gluten-free, non-GMO (genetically modified organism), nutritious cereal that is packed with dietary fibre, which aids digestion and promotes a healthy diet.

Sorghum is also beneficial for preventing allergies, managing obesity, and providing sustained energy.

Apart from the food-based benefits, sorghum can also be processed to brew a product, enjoyed by many South Africans, in the form of sorghum beer.

This crop’s resistance to climate change, ability to withstand drought, heat, and waterlogging from erratic rainfall, make it an excellent alternative to maize.

It is the world’s fifth most important grain, after wheat, maize, rice, and barley.

Sorghum as a traditional crop

Sorghum, scientifically known as sorghum bicolour, is one of the oldest cultivated grains in the world.

In South Africa, its cultivation dates back centuries, with historical evidence suggesting its prominence in the diet and cultural practices of various communities.

Over time, the sorghum industry has evolved, adapting to changing agricultural practices and market demands.

Traditionally, sorghum was primarily grown for subsistence farming, providing a staple food source for many South African households.

However, with advancements in agricultural techniques and the recognition of sorghum’s potential, the industry has expanded beyond traditional boundaries.

Area planted and production

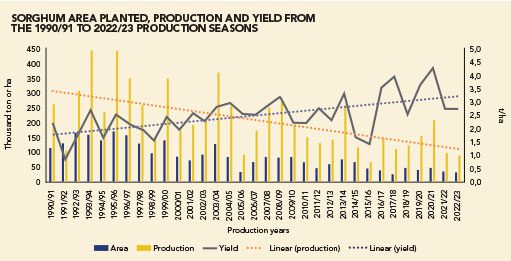

The South African sorghum area planted decreased at a steady rate from the 1990 production season until the current crop estimates figures where it is estimated that approximately 42 100ha of sorghum was planted in the 2023/24 production season.

The area planted to sorghum decreased progressively in all the provinces, except Limpopo, during the past few years.

The area planted is decreasing mainly due to other crops profitability compared to sorghum, producer losses in yield due to quelea damage, the availability of seed technology in, for example, maize, which is increasing yield gaps between maize and sorghum.

READ Factors influencing maize yield

Linked to the decrease in area planted, the local production of sorghum declined at a steady rate over the past few decades.

The average production for the past five years is more than half less than that produced in the early 1990s.

Although a downward trend in the total production is noted, the yield per hectare increased, which can be attributed to the utilisation of more efficient cultivation practices and improved cultivars.

(The figure above indicates the sorghum area planted, production and yield since 1990.)

Consumption

In South Africa, two types of sorghum are produced, namely sweet (tannin class) and bitter (non-tannin class) sorghum. Sweet sorghum is mainly used for flour, rice, and grits, while bitter sorghum is mainly used for indoor and floor malting.

In South Africa, sorghum serves multiple purposes, contributing to both food and non-food sectors. Sorghum is a crucial ingredient in various traditional South African dishes, such as porridge (mabele), bread, and fermented beverages like umqombothi.

Its nutritional value, resilience in diverse climates, and gluten-free nature have made sorghum an attractive option for health-conscious consumers. Sorghum consumption has declined over the past few decades.

This trend is of great concern to industry role players and has been identified as one of the most important aspects that needs to be addressed to establish growth in the industry.

The annual commercial consumption of sorghum during the 1990 marketing season was about 260 000t. It has decreased to the current total consumption of about 150 000t.

This is a decrease of 42%. About 90% of the country’s sorghum production is for human consumption, the largest percentage of which is for the flour, mabele, served as breakfast.

The concerning aspect is that sorghum flour market (rice and gravel) consumption moved sideways from 2010 to 2020.

The importance of sorghum and how it can contribute as a nutritional crops need to be prioritised and marketed among consumers, as this has the potential to increase the demand.

The sorghum industry in South Africa has experienced fluctuations in both supply and demand, influenced by various factors.

Despite its historical significance, sorghum cultivation faces challenges such as unpredictable weather patterns, quelea bird swarms and diseases.

These factors can impact the overall yield and quality of sorghum crops, affecting the supply chain as well as the producer’s profitability.

Sorghum trade perspective

South Africa used to be a net exporter of sorghum but is, specifically over the last few years, becoming more dependent on imports to fulfil South Africa’s local demand.

Sorghum imports fluctuated over the past few years, with the largest import volume during the 2023/24 marketing season, when 90 000t was imported.

READ Feeding your sheep sorghum

When not enough sorghum is produced locally, South Africa needs to import sorghum.

This is not an ideal situation as the country has the ability to produce sufficient sorghum and does not have to import any sorghum.

It is important to note that these imports are not advantageous for local consumers as local sorghum prices trade at higher levels when sorghum needs to be imported.

Imports thus contribute to higher local sorghum prices, which again puts pressure on consumers to buy more expensive products.

The aim should be to be self-sufficient with local sorghum production and have a good balance between consumption and production.

Conclusion

The sorghum industry in South Africa stands as a testament to the country’s rich agricultural heritage and adaptability.

From its traditional role as a staple food to its expanding presence in beverages and livestock feed, sorghum continues to play a vital role in various sectors.

The challenges faced by the industry, such as production constraints and changing consumer preferences, highlight the need for innovative solutions and strategic planning.

Get trusted farming news from Farmers Weekly in Google Top Stories.

➕ Add Farmers Weekly to Google ✔ Takes 10 seconds · ✔ Remove anytime