Annual inflation for food and non-alcoholic beverages rose to 5,7%, compared with 5,1% in June. Sharp increases in beef and vegetable prices the main drivers, highlighting pressure points in South Africa’s agricultural value chain.

Beef price inflation stood out, with prices rising 28,8% year-on-year (y/y). Stewing beef increased from R94,80/kg in July 2024 to R123,87/kg in July 2025, while beef mince went from R102,95/kg to R126,79/kg.

Vegetable price inflation increased to 14,6% y/y in July, up from 13,6% y/y in June. Carrots (up by 20,7% y/y), lettuce (up by 17,5% y/y), and tomatoes (up by 13,7% y/y) were among the biggest contributors to the rise. Carrots, however, saw an 8,8% price decline between June and July.

Dairy and eggs remained in deflation, with eggs and some milk categories cheaper than a year ago, although cheese prices continued to rise (Gouda: up 7,2% y/y; Cheddar: up 5,5% y/y).

Dawie Maree, head of agriculture information and marketing at FNB, said while the consumer price index (CPI) didn’t necessarily have a direct impact on the agriculture sector, it reflected consumer demand, which in turn impacted producers.

Speaking to Farmer’s Weekly, Maree said rising meat prices were mainly the result of two factors: avian influenza outbreak in Brazil, which disrupted poultry imports into South Africa; and ongoing outbreaks of foot-and-mouth disease in South Africa, which limited local red meat supply.

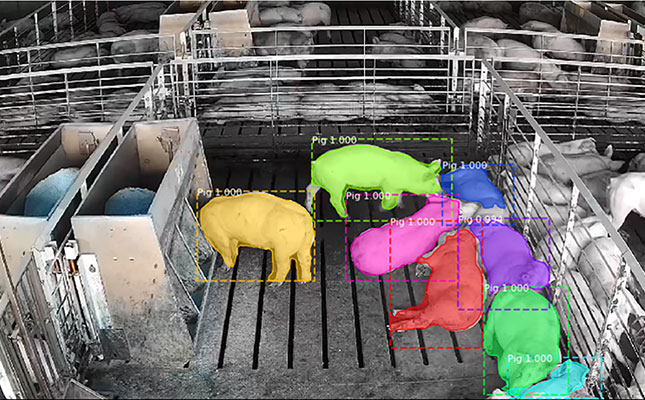

“As [meat] prices increase, consumers tend to spend less on those products. If red meat prices increase further, we can expect consumers to move to cheaper alternatives like poultry and pork, but also to cheaper options in the red meat complex, such as mince. We might see a reduction in red meat consumption, with knock-on effects for farmers and feedlots,” he added.

Meanwhile, Maree said vegetable prices remained volatile: “[Vegetable prices] are normally the more volatile ones because [they] largely depend on supply and demand and weather conditions. With the unexpected winter rain in the summer rainfall area, farmers weren’t able to harvest potatoes in the short term, and that had an effect [on prices].”

He warned that persistently high food inflation could filter through to the CPI.

“This is the number the Reserve Bank uses to make interest rate decisions. If we look at CPI, excluding food, we are still close to the 3% mark, and it should remain moderate in the coming months. Therefore, there is no reason to increase interest rates just yet,” Maree concluded.